The easiest way to apply for a credit card

Today's consumers want the least possible hassle, processing time and related fees when they make credit card applications.

One question that immediately comes to mind is acceptance. Credit card applicants generally should not worry if they comply with all the requirements set by their card issuer. Some of the things that are checked include income ranges, age and current addresses. For potential owners who have moved, they must make sure that they indicate correct information on their previous place of residence, including when and how long they stayed at their former address.

Individuals who want no fuss credit card applications should expect to have their credit ratings given a thorough review. This review will be conducted by issuers to establish if the applicant poses any risk. Such a check will include the individual's ability to remain consistent with monthly rental payments or repayments and mortgage or loan profiles. An applicant with a history of financial troubles will have problems getting their applications processed, as this issue will have an impact on their credit rating.

Credit card providers will also check details such as delayed payments on recent or previous cards, utility bills or loans, and the number of rejected applications, if any. Companies can also probe deeper to the extent that they check the voter electoral register to verify an applicant's address and even the county court to find any judgments against or records on file.

Credit card applicants should realize that low interest providers are more likely to impose a higher number of restrictions and possibly accept only individuals with perfect credit histories. In such cases, the more likely option is for an applicant to consider cards with higher interest rates.

Since borrowing money entails charges, a credit card applicant should make an exhaustive review of all terms and conditions related to their application, preferably across different credit or charge cards. Among the key terms potential card owners must consider are the annual percentage rate, the free or grace period, transaction and annual fees, and adjusted and previous balances.

Some credit card companies will mail a credit card application to the applicant’s home. This is usually an attempt by the issuer to verify that the applicant has provided correct information.

Credit card applications are now more convenient than ever...they can be applied for by telephone and internet-based processing.

As a final note, credit card applicants should always exercise extreme caution when providing their social security number and other personal information during the application process.

NOTE: This site is for general informational purposes. These articles are submitted by independent writers, and we disclaim all liability. It is not a substitute for actual legal, investment or professional advice from a licensed competent individual in their field of expertise.

The information and articles offered on this site are provided with the understanding that the CreditCardWise.com website is not engaged in rendering legal or other professional services or advice. Your use of this website is subject to the additional disclaimers and caveats that may appear throughout this website.

The use of our website and all other materials is at the sole discretion of the reader. We believe that the facts presented are accurate. We disclaim any liabilities from the application of the information contained within, and all information is not intended to serve as legal or financial advice.

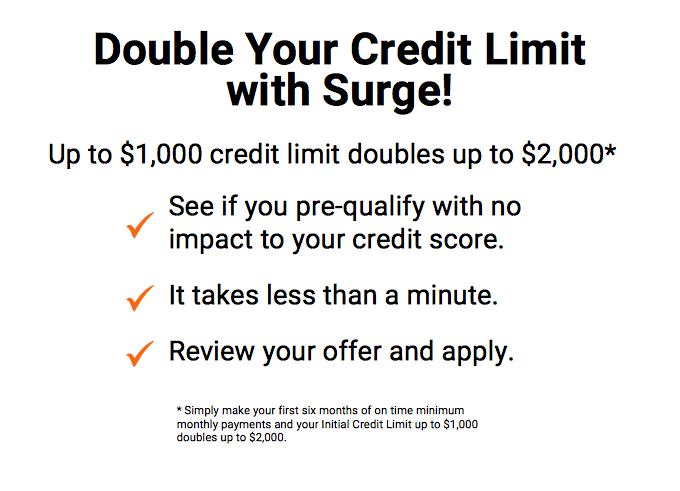

We also post various affiliate offers on our website that are put together by other companies, and not offered by us. The visitor to this website agrees that we are not liable for any and all damages claimed by any one person as a result of any information or materials contained therein for any reason including, but not limited to errors and/or omissions.

One question that immediately comes to mind is acceptance. Credit card applicants generally should not worry if they comply with all the requirements set by their card issuer. Some of the things that are checked include income ranges, age and current addresses. For potential owners who have moved, they must make sure that they indicate correct information on their previous place of residence, including when and how long they stayed at their former address.

Individuals who want no fuss credit card applications should expect to have their credit ratings given a thorough review. This review will be conducted by issuers to establish if the applicant poses any risk. Such a check will include the individual's ability to remain consistent with monthly rental payments or repayments and mortgage or loan profiles. An applicant with a history of financial troubles will have problems getting their applications processed, as this issue will have an impact on their credit rating.

Credit card providers will also check details such as delayed payments on recent or previous cards, utility bills or loans, and the number of rejected applications, if any. Companies can also probe deeper to the extent that they check the voter electoral register to verify an applicant's address and even the county court to find any judgments against or records on file.

Credit card applicants should realize that low interest providers are more likely to impose a higher number of restrictions and possibly accept only individuals with perfect credit histories. In such cases, the more likely option is for an applicant to consider cards with higher interest rates.

Since borrowing money entails charges, a credit card applicant should make an exhaustive review of all terms and conditions related to their application, preferably across different credit or charge cards. Among the key terms potential card owners must consider are the annual percentage rate, the free or grace period, transaction and annual fees, and adjusted and previous balances.

Some credit card companies will mail a credit card application to the applicant’s home. This is usually an attempt by the issuer to verify that the applicant has provided correct information.

Credit card applications are now more convenient than ever...they can be applied for by telephone and internet-based processing.

As a final note, credit card applicants should always exercise extreme caution when providing their social security number and other personal information during the application process.

NOTE: This site is for general informational purposes. These articles are submitted by independent writers, and we disclaim all liability. It is not a substitute for actual legal, investment or professional advice from a licensed competent individual in their field of expertise.

The information and articles offered on this site are provided with the understanding that the CreditCardWise.com website is not engaged in rendering legal or other professional services or advice. Your use of this website is subject to the additional disclaimers and caveats that may appear throughout this website.

The use of our website and all other materials is at the sole discretion of the reader. We believe that the facts presented are accurate. We disclaim any liabilities from the application of the information contained within, and all information is not intended to serve as legal or financial advice.

We also post various affiliate offers on our website that are put together by other companies, and not offered by us. The visitor to this website agrees that we are not liable for any and all damages claimed by any one person as a result of any information or materials contained therein for any reason including, but not limited to errors and/or omissions.